Personal Loan Options

A personal loan through Bank Central can help you achieve your financial goals.

You might be buying a car, a new boat, or satisfying a more expensive hobby. We’re not one to judge. A personal loan with Bank Central is structured to your financial needs, with competitive rates and flexible repayment plans.

Call us today at (719) 309-3339 or visit any Bank Central Location to learn more!

Basic Borrowing

Personal loans can be tailored to stay within your monthly budget. Our interest rates are competitive and our flexible repayment plans can be an effective option to finance anything!

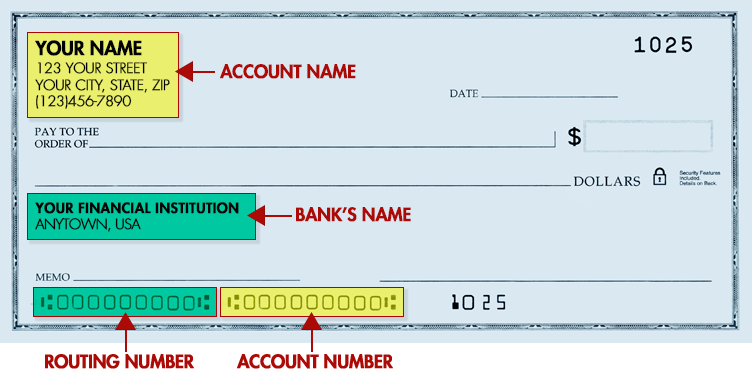

Make Loan Payment Automatic / ACH Loan Payment Form

Home Equity Line of Credit (HELOC)

A HELOC is an open line of credit to help with debt or home improvements

- You have the option to receive cash up front, with the flexibility to use your line of credit at any time for any expense

- Payment options are very flexible

- Your interest may be tax deductible¹

- The interest rate is typically a lot lower than credit cards

Home Equity Loan

A Home Equity Loan is a type of second mortgage – you borrow against your home’s value less the amount of any outstanding mortgages.

- Get cash for a one-time need such as home improvements, pay for college, or buy a second home

- Fixed payments month to month

- Your interest may be tax deductible1

- The interest rate is typically a lot lower than credit cards

Student Loans

Bank Central has partnered with Sallie Mae® to offer you loan options to set you up for success. With Sallie Mae®, you can take out loans with:

- Competitive variable and fixed interest rates

- No origination fee or prepayment penalty

- Multiple repayment options.

There are options for any stage of your education, whether you’re undergrad or working towards a graduate degree, such as:

- Master’s and/or doctoral degrees

- MBAs

- Medical School

- Dental School

If you like to get started, learn more about your options.

-

Consult a tax advisor regarding the deductibility of interest. Back to content